How Dental Insurance Can Save Your Employees Money

Posted Nov 2022

By Delta Dental of Arkansas

Tagged out-of-pocket expenses, agreed-upon rates, saving, comparison, small business, dental insurance

How Dental Insurance Can Save Your Employees Money

Posted November 2022 by Delta Dental of Arkansas

Revised December 2024

Trigger warning: This blog contains a math problem.

What’s the value of dental insurance for your employees? Let’s break it down with a simple comparison to illustrate how dental insurance can save them—and you—money.

The Financial Sense of Dental Insurance

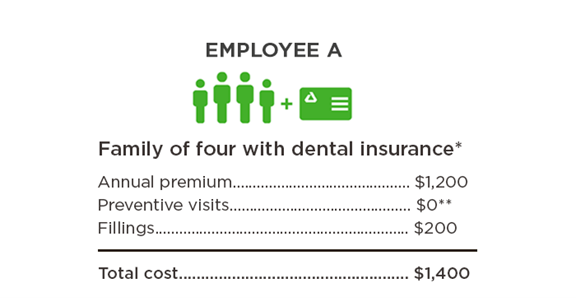

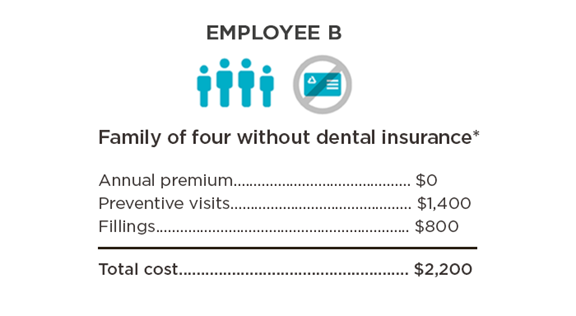

Let’s compare two of your employees, A and B.

- Both have a family of 4 who visit the dentist twice a year for preventive visits, totaling 8 preventive care visits per family.

- Both families have children who need 4 fillings.

Employee A signed up for voluntary group dental insurance through you, her employer. She pays 100% of the monthly premiums.

Employee B declined the insurance. He pays cash for all dental care needs, including preventive care visits and basic and major services.

Comparison: Dental Expenses With and Without Insurance

Notice the difference:

- Employee A total cost: $1,400.

- Employee B total cost: $2,200.

Thanks to dental insurance, Employee A saved $800 compared to Employee B.

Why Dental Insurance Saves Money

How did Employee A save almost 40% on dental costs despite paying monthly premiums?

- Preventive Care Coverage

- Dental insurance often covers preventive check-ups and professional dental cleanings at 100%. Employee A paid $0 for her family’s 8 preventive dentist visits, while Employee B paid $1,400 for the same visits. This alone covers the premium costs for Employee A.

- Negotiated Rates for Services

- Dental insurance companies negotiate lower fees with in-network dentists. Members effectively receive a discount. That’s why Employee A paid 75% less for fillings than Employee B, who paid the full cost.

Preventive Care: Saving More Than Money

Knowing they don’t have to pay out of pocket for preventive care visits encourages employees and their families to see the dentist regularly. Regular check-ups and professional cleanings can prevent complex and costly treatments later on.

2 annual visits are recommended for most people.

- Early Detection and Treatment: Regular visits help dentists spot and treat issues like tooth decay and gum disease early, avoiding more expensive procedures.

- Health Benefits: Dentists can detect up to 120 other health conditions during routine exams, including diabetes, heart disease and kidney disease. Early detection can lead to timely and less costly treatments.

Now your employees have 120 more reasons to sign up for dental insurance and take advantage of preventive check-ups.

In contrast, people without insurance are at a higher risk of skipping needed treatments due to cost, leading to emergency care. In fact, untreated but preventable dental diseases result in more than 2 million emergency room visits each year.

Time-Saving Tools and Resources

Dental insurance also saves time and hassle. Many companies offer tools and apps to make managing dental care easier.

Delta Dental of Arkansas provides:

- Find A Doctor Tool: Find a local network dentist or eye care provider, including specialists.

- DentaQual Rating Tool: Compare the scores of network providers on treatment outcomes, commitment to best practices, cost-effectiveness, patient retention and treatment recommendations.

- Cost Estimator: Get approximate cost ranges for common dental procedures.

- Member Portal: Manage your dental or vision account, view and download ID cards, access and download explanations of benefits, review plan benefits and more.

The Business Value of Dental Insurance

Offering dental insurance benefits your employees and your business. Research consistently shows that providing attractive employee benefits increases employee loyalty and productivity, boosting your profitability.

- Retention: 55% of surveyed employees have left jobs because of inadequate benefits or perks.

Delta Dental of Arkansas: Your Partner in Employee Benefits

Delta Dental of Arkansas offers a variety of dental and vision insurance plans designed for small businesses. With as few as 2 employees, you can start providing an attractive benefits package. We offer the Delta Dental Difference®:

- Affordable Rates: Valuable benefits at affordable prices.

- Easy Administration: Simple application process, no underwriting, and online benefits management.

- Flexible Plans: Options for voluntary plans where employees pay 100% of the premiums.